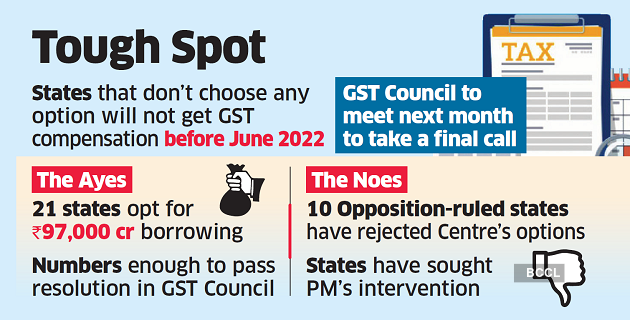

NEW DELHI: Any state that does not choose one of the borrowing options offered by the Centre to compensate for the revenue loss on account of goods and services tax (GST) transition may have to wait till June 2022 to get compensation, a senior government official has said.

As many as 21 states have backed the first option, entailing Rs. 97,000 crore borrowing, more than the requisite number needed to pass a resolution in the GST Council if it is put to vote. This is bound to put pressure on the Opposition-ruled states, which have rejected both the options.

“If the other states do not submit their options before the due GST Council meet, they will have to wait till June 2022 to get their compensation dues subject to the condition that the GST Council extends the cess collection period beyond 2022,” an official said.

The Centre had offered two borrowing options to the states at a specially convened Council meeting on August 27.

In the first option, the borrowing amount is equivalent to revenue loss estimated on account of GST transition that can be borrowed from a special central bank facility. Principal and interest in the first option is to be serviced by the compensation cess. In the second option, states will have to borrow Rs 2.35 lakh crore, entailing revenue loss due to GST transition as transition as also Covid-19 induced slowdown, from the market, facilitated by the Centre and RBI. However, the states would have to bear the interest burden.

Andhra Pradesh, Arunachal Pradesh, Assam, Bihar, Goa, Gujarat, Haryana, Himachal Pradesh, Jammu & Kashmir, Karnataka, Madhya Pradesh, Manipur, Meghalaya, Mizoram, Nagaland, Odisha, Puducherry, Sikkim, Tripura, Uttarakhand and Uttar Pradesh have opted for borrowing Rs 97,000 crore, the official said. Manipur, which had earlier chosen the second option of borrowing Rs 2.35 lakh crore, changed its preference to the first option.

Opposition-led states of Jharkhand, Kerala, Maharashtra, Delhi, Punjab, Rajasthan, Tamil Nadu, Telangana, and West Bengal have rejected both options, and have sought the Prime Minister’s intervention.

Over Rs 1.5 lakh crore as GST compensation is pending to wardsstates for the period April-July, 2020, as the cess collected in the current financial year was insufficient to pay the dues.

Source : TImes of India