NEW DELHI: The government is banking on a widespread private sector participation to boost the leave travel concession (LTC) cash voucher scheme. As is the case of most such schemes, it is designed for central government employees, with suggestions to extend it to a larger base in the private sector, where leave encashment along with leave travel allowance (LTA) is not the norm. For babus, it’s a gift since they couldn’t have claimed LTC without actually undertaking a trip. In contrast, the private sector can pay tax and take the LTA, which is part of the ‘cost to company’.

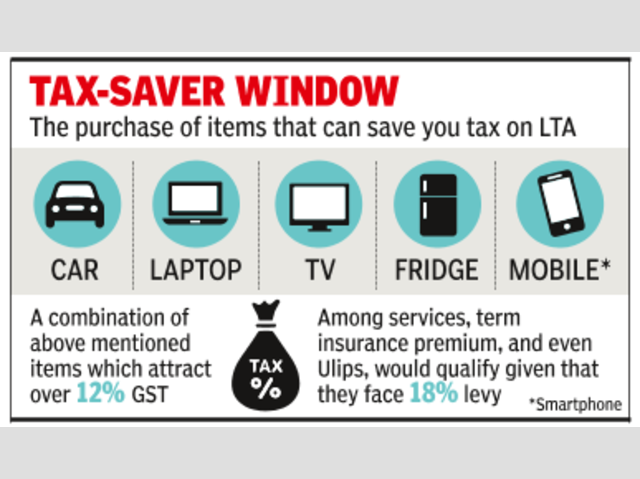

So, here is what’s on the table. If your LTA is Rs 1 lakh for the current financial year, you either produce tickets to claim it as a tax-free allowance or pay Rs 30,000 tax on it. Now, the government is offering you a window where you can avoid paying Rs 30,000 without going on a vacation to Goa or Kerala — provided you spend Rs 3 lakh to purchase a car, laptop, TV set, fridge, smartphones or a combination of these items which attract over 12% GST. Among services, term insurance premium, and even Ulips, would qualify given that they face 18% levy.

“For private sector, LTC is generally one month of basic salary and to save tax on it, he or she will have to spend three times the amount to buy the goods or services attracting at least 12% GST. It may help those who already have the spare money and have requirement to buy such goods or services as they will save tax on it and need not defer their buying decision. But for others, in the current situation of uncertainty for the job and/or pay rise, etc, it may be hard to excite them to buy,” said Rahul Garg, senior tax partner at PwC India.

“We need to wait for the tax amendments that are proposed in the notification. One will have to see how the government aligns the new tax regime which does not permit exemption for LTA with the proposed amendment and also if there is a special window for private sector employees,” said Shalini Jain, tax partner at EY.

Similarly, it is unclear if those who have already withdrawn their LTA entitlement for the year will now be eligible to avail the exemptions.

Source : Financial Express