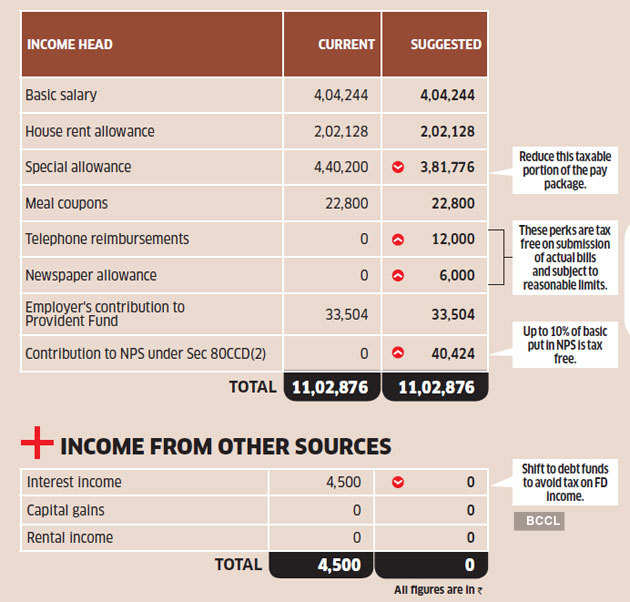

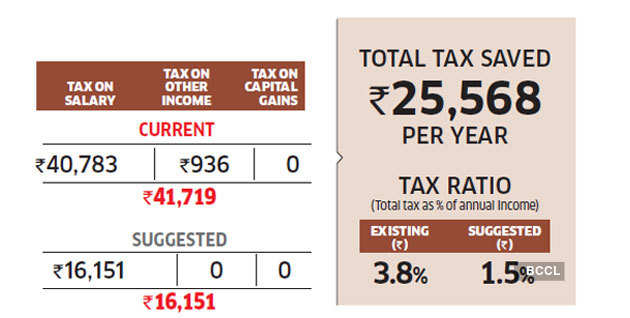

Kolkata-based finance professional Soumik Aikat has a low tax outgo even though his salary structure is not very tax friendly and he doesn’t avail of the tax deductions available to him. Even so, Taxspanner estimates that Aikat can reduce his tax significantly if his pay structure is rejigged to include some tax- free allowances, his company offers him the NPS benefit and he invests in the scheme on his own.

Aikat should start by asking his company for some tax-free reimbursements such as telephone and newspaper bills. These perks are tax free against submission of bills and actual usage. If he gets Rs 1,000 for telephone and internet expenses and Rs 500 for books and periodicals every month, his annual tax will reduce by around Rs 3,750.

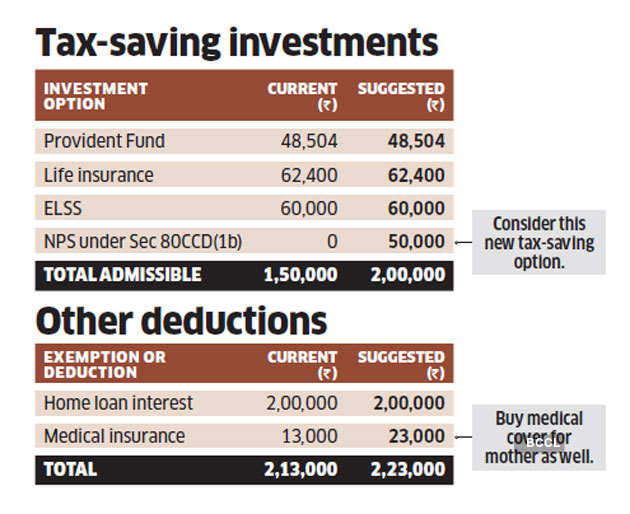

Next, he should ask his company for the NPS benefit under Section 80CCD(2). Up to 10% of the basic salary put in NPS is tax free. If his company puts Rs 3,370 (10% of his basic) in the NPS every month, it will reduce his tax outgo by Rs 8,400. Another Rs 10,400 can be saved if he invests Rs 50,000 in the NPS on his own. At 34, Aikat should opt for an aggressive allocation with the maximum 75% in equity funds.

Aikat has bought health insurance for himself and his wife and child. He should also buy insurance for his mother. This will cost him roughly Rs 10,000, which can further reduce his tax by Rs 2,080. Aikat should also avoid investing in bank deposits. The interest earned is fully taxable. Instead, he should go for PPF or invest in debt funds to defer the tax.

Source : Financial Express