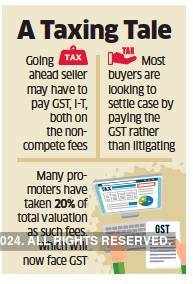

Mumbai: Non-compete agreements during acquisitions that restrict the seller from starting a new venture for some time or poaching employees and customers, have attracted the taxman’s attention.

Several private equity firms, strategic investors and others that have bought businesses and entered into these contracts with the sellers have received notices from the indirect tax department, demanding that they pay goods and services tax at 18% on the non-compete fee.

According to the tax department, a non-compete agreement is essentially a service provided by the seller of the business to the buyer.

One such case involves a Bengaluru-based technology firm that sold the business to some investors for around Rs 1,000 crore. About 20% of the deal value was the non-compete fee. The sellers — a set of promoters — agreed that they would not start a competitive business for three years. They also agreed that they would not approach the company’s current customers in any way.

The buyers have now got a notice asking them to pay GST on the value that is attached to the non-compete agreement.

Another instance involves an infrastructure company where a senior executive had received a non-compete fee from the acquirer of the company for “not disclosing” certain company-related details during the acquisition.

The problem is that many buyers had not taken this cost into consideration, say tax experts.

In M&A situations, the issue that the tax department may seek to levy GST on non-compete fees has been coming up in the recent past, legal firm Pioneer Legal’s managing partner, Satish Kishanchandani, said. “In many cases, this cost has not been accounted for and now the question is who will bear this cost.”

Tax authorities are relying on a particular section of the GST framework that could allow them to tax such transactions, experts said.

“Many non-compete arrangements contain covenants which prohibit the parties from certain acts and transactions and these could potentially be covered by Schedule 2. However, specific terms of the arrangement would impart clarity on taxability,” Deloitte India partner MS Mani said.

In the GST framework, even an agreement to abstain from an economic activity for a consideration is deemed to be a service and must be taxed. “Agreeing to the obligation to refrain from an act, or to tolerate an act or a situation, or to do an act” is also considered an economic activity on which GST can be applied, as per the GST framework.

“Under the law ‘agreeing to the obligation to refrain from an act’ could be considered as a deemed service and if that be so, as per the government’s contentions, a ‘non-compete’ service could come under the purview of GST. While there are arguments against this position, it is imperative to understand that it is government’s intentions to levy tax on such arrangements and organisations need to factor this in,” said Uday Pimprikar, partner and national leader, indirect tax, EY India.

There seems to be a difference of opinion among tax experts over whether tax can be levied on non-compete fees.

Source : Financial Express