The Reserve Bank of India (RBI) is likely to prefer that the Centre borrows and gives money to the states toward goods and services tax (GST) compensation, avoiding the proposed special mechanism for borrowing that would amount to monetisation.

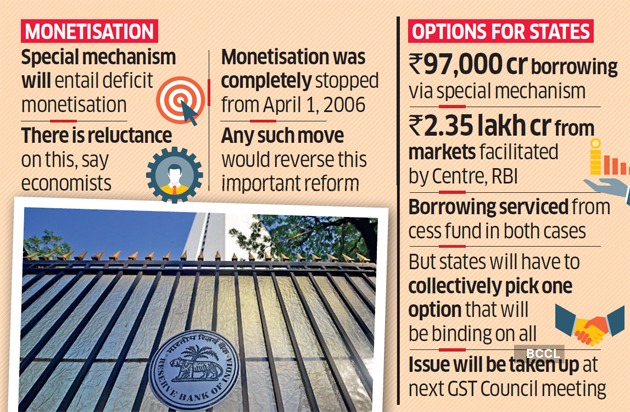

The Centre has proposed two mechanisms to meet the GST compensation shortfall, one of which is through a Rs 97,000 crore central bank window. The second option is that states borrow Rs 2.35 lakh crore — the total estimated GST revenue loss due to the Covid-induced slowdown and the GST transition — from markets, facilitated by the Centre and the RBI.

The Centre is yet to circulate a formal proposal on the borrowing plan to the states that was presented to them at Thursday’s GST Council meeting.

An analyst said individual states may face the issue of higher interest rates than the Centre if they go to market.

Any monetisation by the RBI reverses an important reform and would set a precedent. The government has held preliminary discussions with the RBI on the options offered to states, said a person familiar with the development.

Experts said the central bank would not want the special window.

One Option for All States

“RBI is likely to prefer that the Centre borrows and gives money to states,” Soumya Kanti Ghosh, State Bank of India NSE 4.27 % group chief economic adviser, told ET.

HDFC Bank chief economist Abheek Barua echoed this. “RBI would be reluctant to monetise,” he said. “This (special mechanism) would essentially mean private placement of debt with RBI. It would prefer Centre borrowing from the market and giving to states and recovering that later from compensation cess.”

Ghosh pointed out that contextually RBI is a banker to all state governments but such an arrangement is purely contractual and cannot be used as a reason for state debt monetisation. “As of now, before the beginning of each fiscal year, the feasible levels of the market borrowing for Centre and states together is advised to the government by RBI,” he said in the note.

However, it does not invest in state government loans either in primary issues or in the secondary market, he said. He is not opposed to the idea of monetisation if it is done through the Centre.

“Thus monetisation of state debt is not exactly possible in the current circumstances and it is better if the Centre monetises the debt and gives to states and the RBI will be also comfortable by dealing with the Centre rather than deal with close to 30 sub-national entities,” he said in the note.

Barua said the structuring of the kind of bonds that states will be able to issue also needs to be worked out as interest repayments may not be immediately available as compensation cess collections have been hit by the slowdown.

Monetisation occurs when the RBI directly purchases government securities in the primary market, which essentially amounts to printing more money.

The practice, common in the pre-reforms period, was restricted through government-RBI agreements in 1994 and 1997 and completely stopped from April 2006 with the enactment of the fiscal responsibility law.

Options on the Table

States individually will not have the option to pick one of the two GST compensation options offered by the Centre. They will have to collectively pick one or the other option that will be binding on all. The issue will be taken up at the next GST Council meeting. States have been given seven working days to give their views on the proposals. Repayment for these borrowings will be made via the cess fund after five years.

Both the mechanisms cannot run simultaneously as it would create complications in maintaining them separately for so many states, said a person familiar with the deliberations.

Finance minister Nirmala Sitharaman had said on Thursday that if a state goes for the special window option, it will borrow less and its compensation entitlement will be protected.

Source : Times of India