The Pension Funds Regulatory and Development Authority (PFRDA) is looking to raise the maximum age of entry into the National Pension System (NPS) to 70 years from 65.

“We are also looking at allowing subscribers who join after the age of 60 to continue their NPS accounts till the age of 75,” said PFRDA chairman Supratim Bandyopadhyay. At present, the age limit to continue NPS accounts is 70.

Bandyopadhyay noted that around 15,000 subscribers over the age of 60 have joined the NPS over the past three-and-ahalf years after the age limit was raised to 65 from 60.

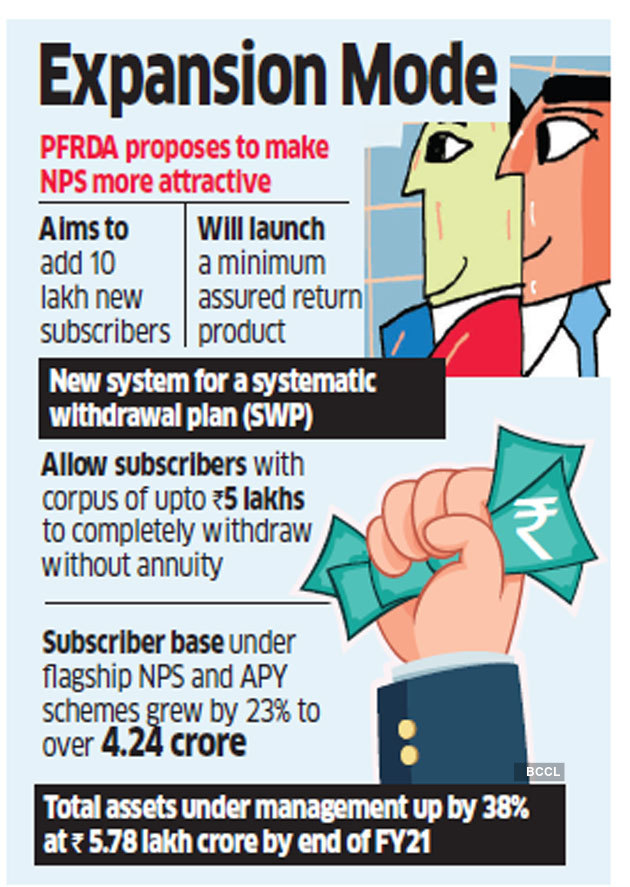

The pension authority, which regulates both NPS and Atal Pension Yojana or APY, has registered 23% growth in its subscriber base under both the schemes with over 42.4 million subscribers by March 31. Total assets under management stood at Rs 5.78 lakh crore.

“Last year was an extremely challenging year because of Covid-19 restrictions, but still there has been growth,” said Bandyopadhyay, adding that the PFRDA expects to add around 10 million new subscribers in the current financial year for NPS and APY combined, up from 8.3 million in the past financial year.

The pension regulator is also considering a proposal to increase the limit for full withdrawal of the pension amount by Rs 3 lakh. At present, full withdrawal is only permissible if the pension corpus is Rs 2 lakh or less.

PFRDA will soon come out with a request for proposals (RFP) for the design of a minimum guaranteed pension product in the NPS. It will also open a 45 day window allowing “on tap” licences for pension fund managers.

Source : Financial Express