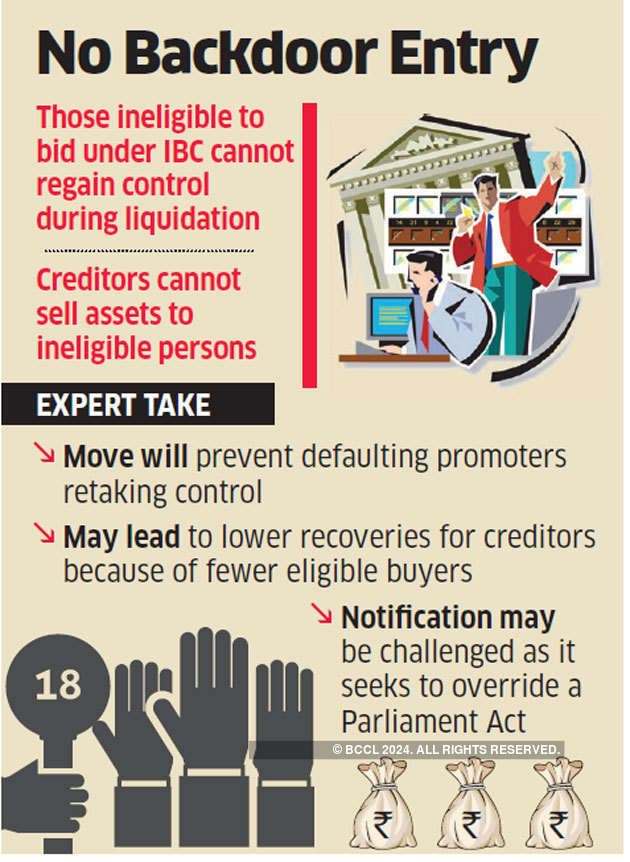

In a significant change in the liquidation framework, the Insolvency and Bankruptcy Board of India (IBBI) has prohibited secured creditors from selling assets of a company to any person restricted from submitting an insolvency resolution plan.

The move will close doors on promoters regaining control of their insolvent firms during liquidation proceedings. The IBBI said it has notified changes to the regulations with effect from January 6. The amendment also provides for a stakeholder to withdraw from the corporate liquidation account.

“The amendment clarifies that a person, who is not eligible under the code to submit a resolution plan for insolvency resolution of the corporate debtor, shall not be a party in any manner to a compromise or arrangement of the corporate debtor under section 230 of the Companies Act, 2013,” it said.

The IBC provides for time-bound and market-linked resolution process for stressed firms. In case the resolution process does not materialise, then the entity goes for liquidation. Section 230 allows for promoters or any class of creditors to reach an arrangement with other stakeholders to take control of the company once it is sent for liquidation.

Further, a secured creditor cannot sell or transfer an asset, which is subject to security interest, to any person who is not eligible under the code to submit a resolution plan for insolvency resolution of the corporate debtor.

Source : Economic Times