A larger bench of the Income Tax Appellate Tribunal is on Monday scheduled to look into a recent amendment of the Income-Tax Act that seeks to curtail the power of ITAT to stay a tax demand without any minimum pay.

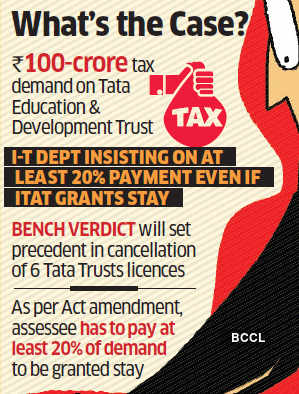

The hearing, in relation with a case involving a ₹100-crore tax demand on Tata Education & Development Trust where the I-T department is insisting on at least 20% payment even if ITAT grants a stay, is keenly monitored as it will set precedent in other cases, including one concerning cancellation of six Tata Trusts licences, people in the know said.

“While the issue has been raised in the matter concerning tax demand raised against Tata Education & Development Trust, the verdict will act as a precedent and will have larger bearing on the Tata Trusts case whose licences were cancelled last year,” a tax official told ET. “The tax department is yet to raise the demand in the said case. The estimated demand is around ₹12,000 crore.”

The larger ITAT bench will decide issues arising out of the amendment to Section 254 (2A) of the IT Act, whereby the assessee has to pay at least 20% of demand to be granted stay. The original Section 254 (2A) provided ITAT with powers to stay a demand for 180 days and then extend it if required, and the tribunal had the liberty to fix the payment for the same.

Tata Trusts declined comment.

Last year, counsel for Tata Education & Development Trust had argued that the new amendment can only be directory and not mandatory on ITAT, or else it would be ultra vires Article 14 of the Constitution of India, said the tax official quoted earlier. “So, the ITAT has referred the matter to a special bench to decide whether the amendment is mandatory or just directive,” the person said.

A legal expert close to Tata Trusts said the Bombay High Court had, in a different case, held that the amendment to one of the provisos to Section 254 (2A) of the Act directory and not mandatory. “There is a plausible view that the amendment by FA 2020 (Finance Act 2020) is not mandatory but directory in nature and it does not curtail powers of ITAT,” said the person on condition of anonymity.

If the interpretation is that the provision is mandatory, it will result in a situation where even if the taxpayer has a favourable jurisdictional court order for an earlier year, he will have to pay taxes on issues that may be settled in his favour, the expert said. “The threshold of 20%, now sought to be imposed, is contrary to CBDT instructions as well as the stand of the department…before Supreme Court.”

Source : Financial Express