Insolvency and Bankruptcy Code 2016, (IBC) in a span of four years, has turned out to be the proverbial giant in the annals of Indian corporate law. The legislation catapulted India in World Bank’s Doing Business rankings from a lowly 142 in 2014 to 63 in 2019. Though not a recovery mechanism, IBC resulted in mean recoveries of 44% for financial creditors in comparison to 24% from Debt Recovery Tribunals (DRT), SARFAESI Act and Lok Adalats combined, for financial years 2018-2020.

Jurisprudence of any legislation takes time to evolve and IBC was no exception; interpretation of contentious clauses for corporate insolvency are now settled. Covid-19 disrupted IBC’s stellar run as filings under IBC were suspended effective 25th March 2020. One area that required bolstering even before suspension was the National Company Law Tribunal (NCLT). As of 31st July 2020, total 19,844 cases were pending before NCLT of which 12,438 pertained to IBC. Approximately, 3,000 cases are undergoing resolution and liquidation, implying that 9,000 cases are pending admission. An opportunity to reduce the backlog amidst Covid-19 was missed, which would have been possible, with better infrastructure, more members,

Filing was deferred due to Covid19 in most jurisdictions, barring the US. Mature insolvency jurisdictions either had a plethora of tools to navigate insolvency in their armoury or had the template to assemble one. As an example, Britain had administrations, pre-pack, company voluntary

arrangements, receiverships, and scheme of arrangement under Companies Act; all procedures in congruence with each other. The template European countries relied on for a quick pivot in 2020, was based on the European Union Directive (EUD) on Preventive Restructurings 2019/1023. Thus, Britain was able to roll out CIGA 2020, Netherlands its WHOA and Germany its StaRUG. All the aforesaid insolvency frameworks are geared towards pre-insolvency restructuring and have common elements like debtor-in-possession, pre-insolvency moratorium, cram-down of dissenting class, set-aside ipso-facto clauses etc.

India too has several tools/laws to deal with insolvencies. However, these laws are operating in silos, are not speaking to each other, and have certain deficiencies. Apart from the IBC we have the Reserve Bank of India (RBI) Prudential Framework, SARFAESI Act and section 230 of Companies Act 2013.

Prudential Framework does not involve all forms of financial creditors; mutual funds and insurance companies are left out of its ambit. Thus, enabling legislations and/or guidelines by SEBI, IRDAI and RBI jointly can resolve this anomaly.

Asset Reconstruction Companies (ARC’s) work under the auspices of SARFAESI Act. Given the paucity of funds, “managing” the assets, with tweaks in clauses to facilitate change of management and appointment of manager with more powers, akin to a chief restructuring officer, will be value accretive. Also, DRT should be subsumed within NCLT for consistency of judicial outcomes.

A draft framework of prepacks has been published. IBC inherently is geared towards the sale of a company as a going concern, thus, to avoid litigation a comprehensive chapter for prepacks will be appropriate. Prepack is a colloquial term. An endeavour should be made to leapfrog the “traditional-prepack” and adopt best practices of EUD. Thus, we should include pre-default abinitio, protect transactions undertaken from subsequent insolvency procedures, waive 29A for defaults after 25th March, allow modification of executory contracts, valuation only in exceptional cases and concomitant enabling amendments in Companies Act and SEBI guidelines for outcomes that require shareholders’ approval.

Section 230 of Companies Act 2013, though steeped in history, is rarely used as the process of seeking approval from each class of creditors and shareholders is cumbersome and is best left for reorganization of solvent companies.

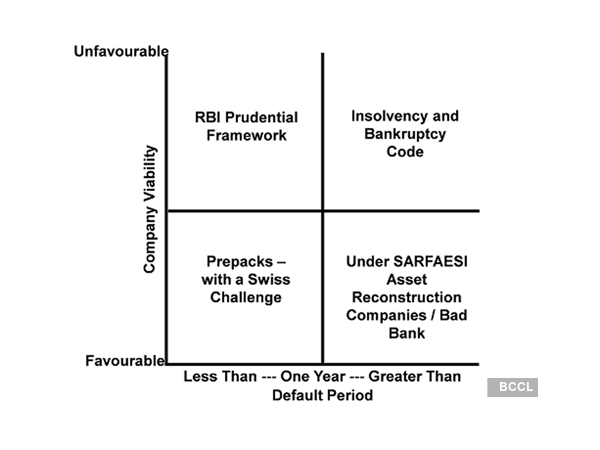

Thus, harmonization of procedures with certain common tenets, post appropriate legislative changes, alongside lifting of suspension will help insolvency laws achieve their true potential. One plausible decision matrix of the same is illustrated.

Additionally, tax matters arising from any of the aforesaid procedures should be addressed. Carry forward of losses, in case of companies, in which the public are not substantially interested, should be allowed. Also, profits arising on write back of loan irrespective of its end-use i.e., capital assets or working capital, interest, and payables, should not be taxed.

Source : Financial Express