The road towards changing the Insolvency & Bankruptcy Code (IBC) is less simple than it seemed a fortnight ago when the finance minister announced a suspension of fresh IBC proceedings in the wake of Covid-19 pandemic.

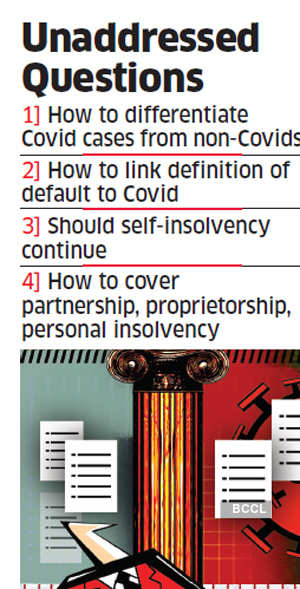

The government, it is widely felt, will have to involve the Reserve Bank of India (RBI), large lenders, and some of the other stakeholders to deal with questions that have cropped up in considering an ordinance: How to differentiate borrowers hurt by Covid from those impacted by other factors? How to link the definition of default to Covid-19? Will there be a cut-off date to identify borrowers for whom IBC may still apply? Will self-insolvency continue? Should IBC include partnerships and personal bankruptcy to cover smaller businesses?

The proposed Ordinance will also have to consider allowing existing companies to do their own restrucuring under IBC in the present environment.

“Pulling the shutters down on IBC may not be the best solution. There is no logic in restraining a debtor, which is struggling, from commencing insolvency. In any case, suspending provisions without changing the RBI Circular of June 2019 will not help. A proper consultation with RBI and other stakeholders should be initiated,” said Sumant Batra, managing partner at the law firm Kesar Dass & Associates.

Just as financial and operational creditors can initiate the IBC process on a company, the code allows the corporate debtor to opt for self-insolvency.

According to RBI rules, banks have to review the borrower within 30 days of the first default and implement a resolution plan within the next 180 days, failing which they have to make extra provisioning (which eats into their profits and capital).

RBI, according to banking circles, is likely to insist that it should have the final say on any change in the definition of default in IBC in the context of the pandemic. RBI has given a six-month moratorium beginning March 1 on interest servicing and loan repayment.

“Should IBC continue for borrowers which defaulted before March 1? Should it be for those where banks have reached an inter-creditor agreement (during the 30-day review post default)? Should the moratorium period be considered under the IBC framework?” a senior banker asked.

“While the moratorium and lockdown happened in March, there are borrowers who suffered due to supply chain disruption in February or January,” said a senior official of a large PSU bank. All these issues will have to be dealt with before the government finalises an Ordinance for amending IBC to take care of stress caused by Covid-19.

According to Ashish Pyasi, Associate Partner at Dhir and Dhir Associates, if the amendment is intended only to exclude default to operational creditors then consultation with RBI may not be required. “However,” said Piyasi, “suspension of all provisions is not the best solution. If financially stressed companies are stopped from approaching the NCLT then they are forced to carry the dead wood. It would worsen their stress as debts will rise and the value of assets will be depleted.”

More than 80% small and medium enterprises are partnerships or proprietorships. “I wonder how IBC can help them without first operationalising the part of IBC relating to individuals. And that part needs a major overhaul before it is fit for implementation as the government has indicated earlier. We are talking about a large number here,” said Batra. At present, the issue of individual insolvency in IBC is connected with invocation of corporate guarantee. “On this matter, consultation with state governments would be needed as personal bankruptcy is a subject on which states can also legislate,” he said.

While IBC is considered as a full-fledged resolution mechanism compared to other laws which largely focus on recovery, many lenders, particularly state-owned banks, are not in a hurry to initiate IBC proceedings as long as the regulator gives them leeway in restructuring loans. “IBC may mean a distress sale of business in the present environment. But if IBC is deferred and a one-time loan restructuring window is not offered, then there will be no meaningful resolution path left,” said another official of a private sector bank.

Source : PTI