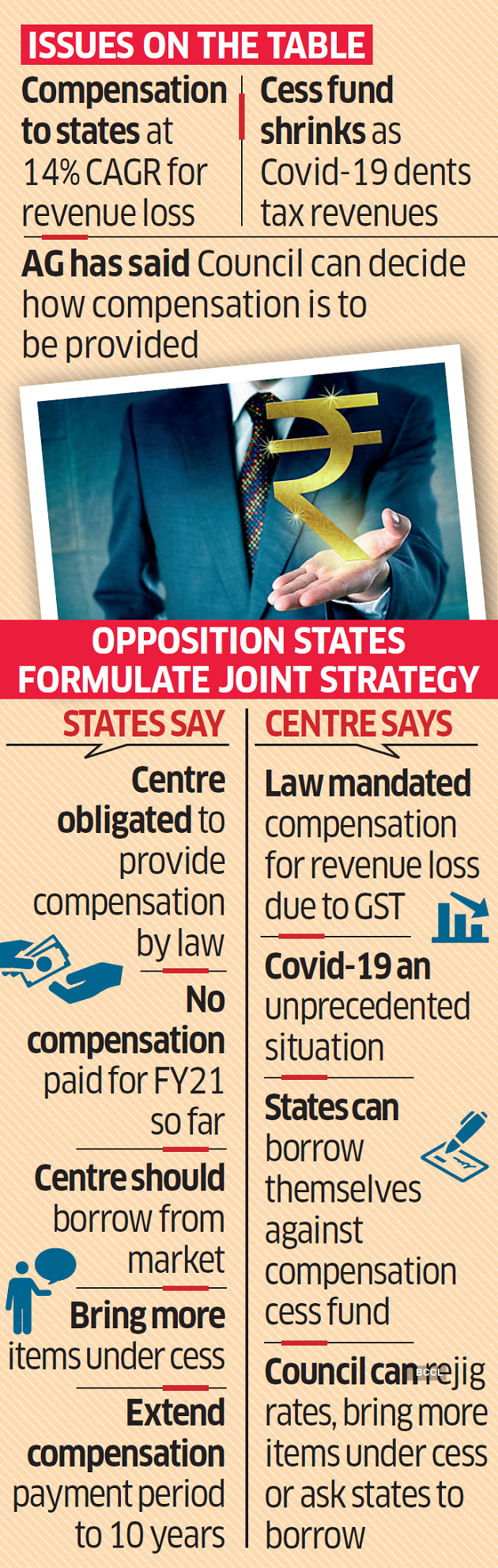

The Goods and Services Tax (GST) Council meeting on Thursday is expected to be a stormy one as states are set to clash with the Centre on the issue of delayed compensation payments. Those ruled by the opposition have opposed the idea that states should themselves borrow from the market if the Centre is unable to pay GST compensation because of revenue constraints.

The Centre is yet to pay the first instalment of GST compensation to states for the current financial year. These are typically paid out on a bi-monthly basis. It paid about Rs 1.65 lakh crore to states in FY20.

These states are likely to push the Centre to borrow from the market and suggest that the compensation cess is levied on more products to raise funds.

Tax collections hit by pandemic

They may also call for the compensation cess to be extended to 10 years from present five, ending in 2022.

The Centre is expected to press the states to borrow individually from the markets, relying on the attorney general’s opinion. The Centre had told the standing committee on finance in July that it may not be able to pay GST compensation due to states as tax collections took a hit due to the economic slump owing to Covid-19 and th ..

These states are likely to push the Centre to borrow from the market and suggest that the compensation cess is levied on more products to raise funds.

Tax collections hit by pandemic

They may also call for the compensation cess to be extended to 10 years from present five, ending in 2022.

The Centre is expected to press the states to borrow individually from the markets, relying on the attorney general’s opinion. The Centre had told the standing committee on finance in July that it may not be able to pay GST compensation due to states as tax collections took a hit due to the economic slump owing to Covid-19 and the subsequent lockdown.

Money raised through the cess is paid to the states as compensation for the loss in revenue because of GST.

“This refusal to compensate the states (for GST payments) is nothing short of betrayal,” Congress president Sonia Gandhi said on Wednesday after a meeting with the chief ministers of seven states – Maharashtra, Punjab, West Bengal, Rajasthan, Chhattisgarh, Jharkhand and Puducherry.

“If there’s no money, how will the states work? It is our right to ask for what’s due,” said Maharashtra chief minister Uddhav Thackeray.

Financial crisis

Punjab chief minister Amarinder Singh said the state will be in a serious financial crisis due to the lack of funds from GST, which has dropped by over 38% from last year. “This FY we will end at a deficit of Rs 25,000 crore. We’ve given all the powers of tax collection to the prime minister, we’ve given up our rights,” he said. “Now they’re saying they can’t pay – we should go to the PM and present this issue.”

West Bengal also demanded compensation dues. Chief minister Mamta Banerjee said the state will need to levy additional taxes to meet the funding shortage as the Centre was yet to pay Rs 4,100 crore as GST compensation.

The states are not ready to accept lower compensation due to the revenue collapse because of the Covid-19 pandemic and the lockdown.

Punjab finance minister Manpreet Badal said more items will have to be brought under the ambit of compensation cess to raise more funds. He also advocated a dispute resolution mechanism in case no consensus is reached.

The meeting is being held solely to discuss compensation payments to states for revenue loss on account of GST implementation. It will consider the attorney general’s opinion that the council is empowered to take a call on how states have to be compensated and borrowing from the market to meet the shortfall, if any.

Bihar deputy chief minister and finance minister Sushil Modi said states can borrow from the market if the Centre stands guarantee.

“This means that it (state) will get repaid from the compensation cess fund over a much longer duration (tenure of loan),” he said, but also questioned such a mechanism. “How can that (repayment) be done when the fund is not adequate to meet the monthly requirements.”

The middle path

States could pitch for a mechanism where states may borrow but the Centre would manage the entire borrowing including repayment and interest, an official said.

Sources said that the GST compensation cess requirement of Rs 26,000 crore per month for FY 21 had arisen due to the unprecedented pandemic, nearly double of Rs 13,775 crore paid each month previous fiscal.

As per law, the GST Council shall compensate for loss of revenue emanating from implementation of GST, which is different from dual factors of economic slowdown and the pandemic.

Source : Times of India