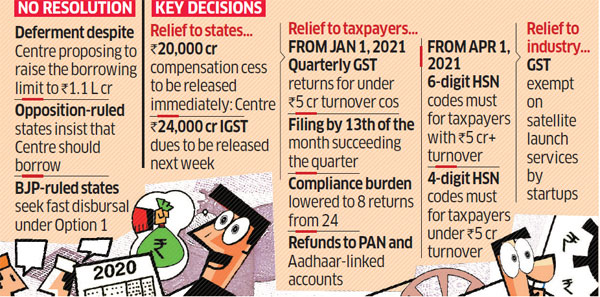

The Goods and Services Tax (GST) Council was deadlocked on the issue of compensation to be paid to states on account of the shortfall stemming from the transition to the levy in 2017. It however decided to extend the compensation cess beyond 2022—the five-year period that had been agreed originally. The council will meet again on October 12 to discuss the issue.

The Centre will immediately disburse Rs 20,000 crore collected in the cess fund in the current financial year to states, Union finance minister Nirmala Sitharaman, also the council chairman, told reporters after its Monday meeting.

“This would be disbursed tonight itself,” she said. On integrated GST distribution, she said Rs 24,000 crore will be paid to states that had not received the payment as recommended by a group of ministers.

GST collections have fallen short on account of the Covid-19 pandemic, in turn hitting compensation to states. Opposition-ruled states maintain that the Centre should borrow from the market to raise the money for compensation payments. The Centre wants the states to make the borrowings themselves instead.

About 20 states had opted for the first of two choices offered by the Centre–borrowing Rs 97,000 crore, since raised to Rs 1.1 lakh crore–but the minster said a broader consensus was needed.

“You can’t decide on the 20 states that have written–we need to talk further and I can’t take anyone for granted and I’m open for more and more talk,” Sitharaman told reporters.

When asked about some states saying that compensation was a matter of law, she said: “Nobody is going to be denied compensation… We have not denied compensation to states… It is not as if the Centre is sitting on money and denying them.”

The Centre proposed to raise the borrowing limit to Rs 1.1 lakh crore from Rs 97,000 crore as suggested by some states in their feedback, pruning the expected revenue growth to 7% instead of the 10% previously estimated over the last financial year.

Under the proposed arrangement by the Centre, the compensation cess will first meet interest on the Rs 1.1 lakh crore borrowing and then service 50% of the principal. The balance will be used to pay the remaining amount of compensation.

“Ten states demanded that full compensation should be paid to the states during the current year as per clauses in the law and Centre should borrow,” Kerala finance minister Thomas Isaac said. Among them were Andhra Pradesh and Telangana, which categorically stated that the Centre should borrow funds and give the money to the states.

Borrowing not Council’s mandate

A government official told ET that the GST Council cannot hold a vote on the borrowing options as this was not part of its mandate.

“No division can take place on the borrowing as it was not within the jurisdiction of the Council,” the official said, adding that the issue was under the remit of the Department of Expenditure as laid down under Article 293 of the constitution. The compensation cess was under the mandate of the council and hence a decision was taken to extend it, the official said.

The official cited the attorney general’s opinion that even though the GST Council can recommend to the Centre that states be permitted to borrow, the Centre has to take a decision under Article 293. The official said the opinion clearly stated that the GST Council’s decision was not necessary for allowing a state to borrow. “The states can approach the Department of Expenditure, take permission under Article 293 and borrow. GST Council’s recommendation is not a necessary condition for giving permission to a state to borrow,” the official said.

Ease of compliance

Among other decisions, the GST Council made several compliance-related changes to provide relief to small taxpayers.

From January 1, 2021, taxpayers with an annual turnover less than Rs 5 crore need not file returns monthly but only every quarter. Taxpayers’ compliance burden will be reduced to eight returns from 24 now, finance secretary Ajay Bhushan Pandey said. Tax payments can be made through a simplified challan by these taxpayers.

From April 1, 2021, taxpayers with more than Rs 5 crore turnover will have to compulsorily mention harmonised system nomenclature (HSN) codes up to six digits. Those having less than Rs 5 crore turnover will have to mention HSN codes up to four digits. HSN is a goods classification system.

Pandey said refunds will be disbursed through validated bank accounts linked to PAN and Aadhaar. The council also exempted 18% GST on startups involved in providing satellite launch services to ISRO, Antrix Corp. and New Space India Ltd.

Source : Times of India