The Centre could include a host of off-budget spending and other government liabilities on its books to give a clearer picture of finances though this could raise the fiscal deficit sharply.

Top government officials have held discussions on the move amid budget preparations and there is a growing view that a full picture is needed. Finance minister Nirmala Sitharaman will present the budget on February 1.

“A clear account of real fiscal deficit should be presented…There have been discussions,” said a government official. There have also been suggestions that the government switch to accrual-based accounting from cash, which means including payments it owes.

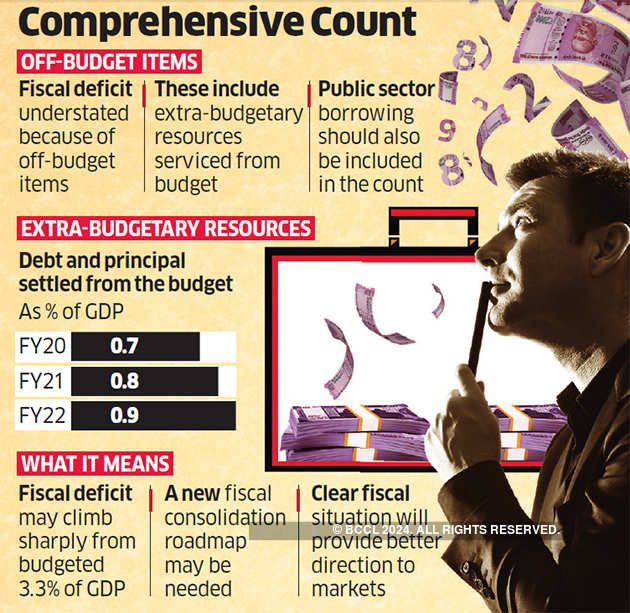

The government has budgeted a fiscal deficit of 3.3% of GDP in the year to March. The fiscal deficit numbers have been criticised for excluding a number of items for which the general budget is liable.

The move will mean the fiscal deficit for FY20 could get pushed to 4.5% or higher.

Experts and others have repeatedly raised the issue of India’s fiscal deficit numbers being understated. The Comptroller and Auditor General (CAG) had in July said in a presentation to the Finance Commission that the central government’s key deficit figures may be considerably higher than those stated in the Union budget. In its assessment last month, the International Monetary Fund (IMF) also pointed to fiscal deficit suppression.

“Despite some improvement in reported fiscal deficits, debt as a share of GDP remains little changed over the past decade, partly due to increases in off-budget financing,” it said, estimating public sector borrowings at 8.5% of GDP.

In a blog post earlier this month, former finance secretary SC Garg had pointed to an understated fiscal deficit, pegging it at 4.66% and 4.39% in FY19 and FY18, respectively, rather than the 3.4% and 3.5% shown in the budget. Garg was in the finance ministry, heading the department of economic affairs, in those years.

The government has been providing an estimate of some off-budget items separately, but this is not included in the headline fiscal deficit.

Such extra budgetary resources are pegged at 0.7% of GDP in FY20 and seen rising to 0.9% of GDP by FY22. The government defines these extra budgetary resources as those financial liabilities that are raised by public sector undertakings for which repayment of entire principal and interest is done from the union government budget.

In effect, these fully serviced bonds are the Centre’s liabilities, pegged at Rs 88,454 crore at the end of March 2019, or 0.5% of GDP. In addition, there is debt raised by entities such as the Food Corporation of India that is in effect a liability of the government and should be included in its debt and fiscal indicators.

Experts said that since the government will anyway miss the 3.3% target for the year, it should look at cleaning up finances.

“It will make the budget process and budget numbers far more credible. Markets will find it much more credible,” one of them said, arguing for a new glide path for the fiscal deficit after accounting for all off-budget borrowing.

The fiscal responsibility law requires the government to attain a fiscal deficit target of 3% by FY21.

State Bank of India group chief economic adviser Soumya Kanti Ghosh sees the fiscal deficit at 3.8% in the current fiscal.

Source : Times of India