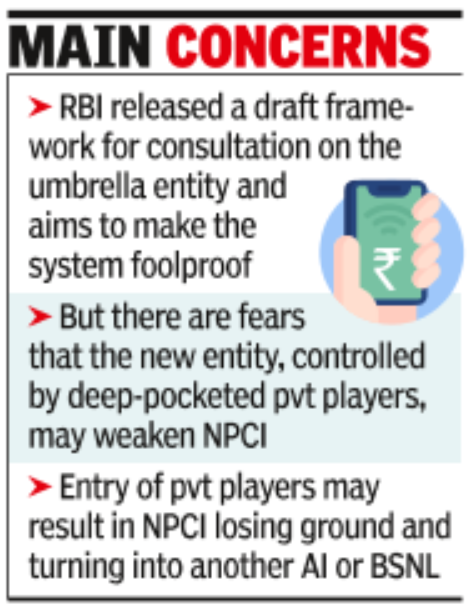

NEW DELHI: The government has expressed concern over the proposed new umbrella entity for retail payments resulting in a mechanism that is controlled by Indian or foreign corporate giants and undermining the efforts of the National Payments Corporation of India (NPCI). The entity will be tasked with crucial operating systems such as ATMs, point-of-sale machines, Aadhaar-based payments as well as remittances.

The finance ministry has conveyed its concern to the Reserve Bank of India (RBI), which had released the framework in August and has invited applications till the end of February, sources told TOI. The government is of the view that the payments system should be treated as a core government function like issuing voters’ ID or Aadhaar, and the private sector should be kept out.

On its part, the RBI is looking to ensure that the system is firewalled so that it does not result in a private player controlling the space, sources pointed out. The RBI opted for a rival outfit to avoid concentration of payments risk and the entire system being controlled by one entity, the NPCI. It had also said that competition would lead to innovation and increased efficiency.

Currently, the framework provides for a “for-profit” entity to be set up under the Companies Act with diversified shareholding. A single promoter will not able to hold over 40%, with the requirement to dilute it to 25% after five years of being in business. Like most aspects of the financial sector business, the “fit and proper” criteria will be used for directors.

Even within the RBI, there are apprehensions. In order to encourage digital modes of payments, many central bankers feel it is necessary to ensure they are available free of cost, which might not be the case if the provider were a for-profit entity.

Source : Economic Times