Multiple GST slabs and interpretations — both by businesses and government authorities — are ensuring that there is never any shortage of classification problems. At least three cases have been dealt with by various authorities, with companies seeking production interpretations, which in many cases were clear.

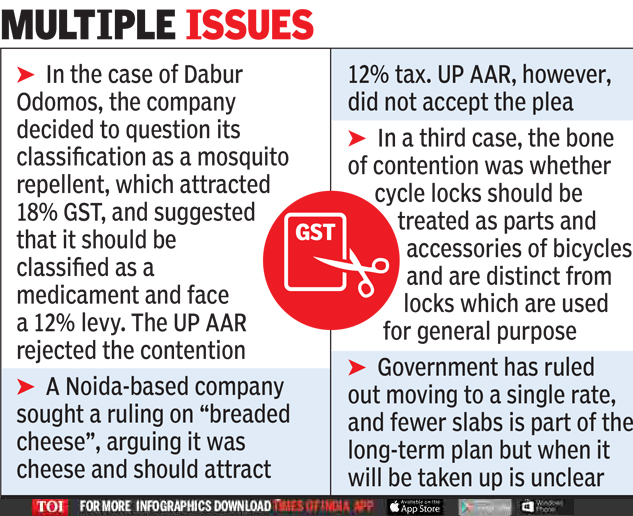

Take the case of Dabur NSE -0.12 % odomos, which has been used as a mosquito repellent for years. But the company decided to question its classification as a mosquito repellent, which attract 18% GST, and suggested that it should be classified as a medicament and face a 12% levy.

The Uttar Pradesh Authority for Advance Ruling (AAR), however, rejected the contention, which means that it will face 18% tax. It observed that the product’s odour makes the conditions unattractive for mosquitoes, when it is coated on a human body.

Similarly, a Noida-based company sought a ruling on “breaded cheese”, arguing that it was cheese and should attract 12% tax. Again, it was arguing before the UP AAR. The authority, however, did not accept the plea.

Relying on the definition, it observed that the product should retain its character as cheese even after being coated with batter and bread crumbs and should be partially pre-cooked. “…these are not cheese per se but have converted into an article of cheese having the identity and characteristics of snack foods,” it said. It further added that products made from potato or flour are sold as distinct food items and not as the basic ingredient.

Besides, it observed that with 55% content, cheese was a major component but it wasn’t present in a quantity that it pre-dominated or overwhelmed the presence of other ingredients, while rejecting the plea.

In a third case, the bone of contention was whether cycle locks should be treated as parts and accessories of bicycles and are distinct from locks which are used for general purpose.

“More than 400 pages of HSN code book with around 19,000 tariff entries, multiple use of products, dichotomy between usage and key components, technical meaning vs common parlance, specific use vs generic use, etc, are all ingredients for the classification dispute recipe. Around 49 countries use single rate and 28 use dual rates. Having single rate or fewer slabs appears to be the only solution for reducing classification disputes in India,” said Harpreet Singh, partner for indirect taxes at KPMG.

Although the government has ruled out moving to a single rate, fewer slabs is part of the long-term plan. But when exactly will that plan be taken up by the all-powerful GST Council is not quite clear.

Source : Times of India