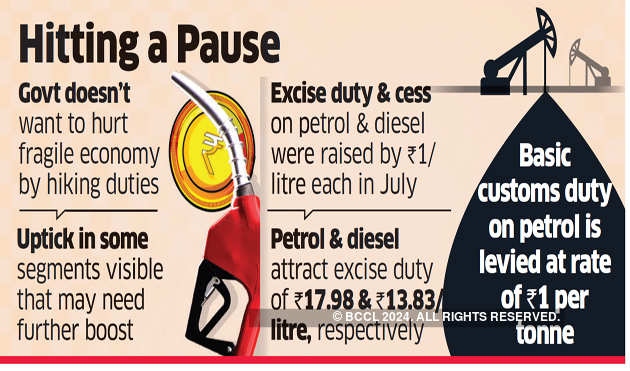

The government is not looking to raise excise duties on petrol or diesel, or to increase basic customs duty on crude despite revenue pressures, apprehensive that such a move could derail the recovery seen in some segments of the economy, a senior official said.

“At this juncture, recovery is still fragile…There is a need to avoid shocks,” the official told ET, confirming there is no plan to increase duties on crude and petrol and diesel.

However, a final call on the any change in duties will be taken at the highest political level.

The government had in July last year raised excise duty and cess on both petrol and diesel by Rs 1 per litre each. Petrol attracts excise duty of Rs 17.98 per litre and diesel Rs 13.83 per litre.

Basic Customs Duty on crude petroleum is levied at the rate of Rs 1 per tonne. Besides, there is countervailing duty also of Rs 1 per tonne and National Calamity and Contingency Duty of Rs 50 per tonne. A social welfare surcharge at the rate of 10% is also levied on all.

Global crude prices on Monday witnessed the biggest drop in prices since the 1991 Gulf War. Brent fell to $31.02 per barrel while India’s crude basket prices hit $45 per barrel. Indian basket represents the average of Oman, Dubai and Brent crude.

India imports about 85% of its oil requirement and this plunge in prices will have a positive impact on its import bill. In the past, the government had refrained from passing fall in prices to consumers and instead raised excise duties on petrol and diesel to collect more tax.

“We are keeping a close watch,” a second official said.

The government believes that the economy has bottomed out and there are some signs of a pickup in some segments that need to be encouraged. Indian economy grew 4.7% in the December quarter, its slowest pace in nearly seven years, declining further from an upwardly revised 5.1% in the previous quarter.

Source : Financial Express