Mumbai: Top digital companies including Amazon, Flipkart, Bookmyshow and Facebook have sought clarity from the government on how a 1% tax on ecommerce transactions announced in the previous budget would be levied.

The first instalment of the new tax is due in October and there is some ambiguity over how it is to be calculated, experts said.

Companies want the government to come out with precise rules for this tax, which they are to deduct before payments to vendors, and how certain transactions should be treated.

The new section that includes the 1% tax says, “Where sale of goods or provision of services of an ecommerce participant is facilitated by an ecommerce operator through its digital or electronic facility or platform (by whatever name called), such ecommerce operator shall, at time of credit of amount of sale or services or both to the account of an ecommerce participant or at the time of payment thereof to such ecommerce participant by any mode, whichever is earlier, deduct income tax at the rate of 1% of the gross amount of such sales or services or both.”

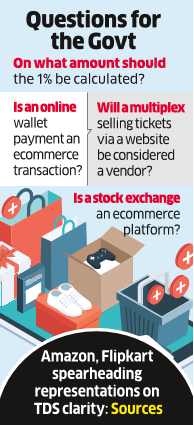

According to companies and their tax experts, there is no clarity on several issues. The section also does not define “service” and “gross amount.”

“It would be useful if the government can issue FAQs on the applicability of these provisions to different situations because there are several open issues. For instance, it is not clear as to what kind of services would be covered in scope since the term ‘services’ can be very far-reaching,” said Rajesh H Gandhi, a partner at Deloitte India. “Also, the law is not clear whether foreign operators and vendors are covered. Questions also arise on extension of the levy to payment service providers, transactions where there is an offline component and those relating to the travel industry.”

A Flipkart spokesperson indicated that the tax would hurt micro, small and medium enterprises that sell their products on ecommerce sites by blocking their cashflows. “Some ways to further support MSMEs could include supporting them with a liberal tax compliance regime which does not impact cash flows adversely for these small businesses,” the spokesperson said. “The tax can neither be absorbed by Flipkart nor passed on to consumers as it has to be deducted from the payments being made to sellers.”

Amazon, Bookmyshow, Facebook and the government did not respond to questionnaires sent on Monday afternoon.

Some experts said the government’s intention may have been to rein in vendors escaping the tax net. Ecommerce companies are also seeking clarity on refunds of tax amounts when there are cancellations.

Source : Times of India