The Delhi High Court on Thursday asked the Ministry of Finance and the Reserve Bank of India (RBI) to consider bringing in parity in certain sections of the Insolvency and Bankruptcy Code (IBC) and the Sarfaesi Act, which has created hurdles in the resolution plans of bankrupt telcos Reliance Communications (RCom) and Aircel.

The High Court was hearing a writ petition filed by asset reconstruction company UVARCL against a show cause notice issued by the RBI in which the regulator had threatened to cancel its ARC license.

The court also directed the finance ministry to submit its response by April 18.

In an earlier hearing, Justice Navin Chawla had held that mere submission of resolution plan cannot be held illegal and stayed RBI’s proceedings in the matter.

“The court has advised the ministry of finance and the RBI to come up with their views on the matter and consider bringing consistency in these two laws,” said a person aware with the matter.

The matter will next be heard on May 19. Both RBI and UVARCL did not respond to ET’s queries.

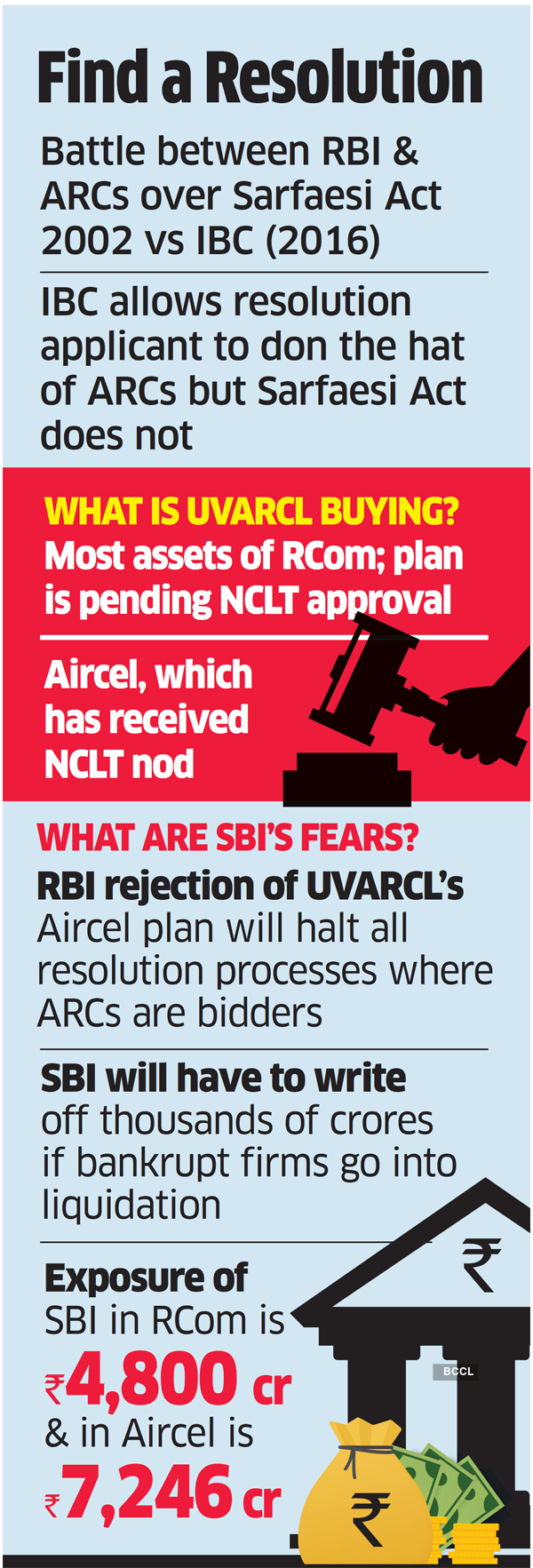

According to the Sarfaesi Act (Securitisation and Reconstruction of Financial Assets and Enforcement of Securities Interest) asset reconstruction companies that take over stressed assets from lenders cannot infuse equity into an insolvent company at the resolution stage. They also cannot act as resolution applicants.

UVARCL’s stance is that the Insolvency and Bankruptcy Code — which allows for such investments — supersedes the rules stated in the Sarfaesi Act.

In its writ petition, UVARCL had sought appropriate court directions to the finance and corporate affairs ministries, RBI, and the IBBI for resolving what it called a policy gap arising due to the lack of guidelines on the participation of ARCs as resolution applicants.

The company has also stated in its petition that since it had expressly revealed that it aimed to invest equity in Aircel, there had been no violation of the guidelines laid down by the banking regulator.

ET had last year reported that in its notice to UVARCL, the banking regulator had alleged that the rehabilitation company had failed to alert the insolvency court that the RBI had rejected its resolution plan for Aircel. According to the regulator, the ARC had flouted the rules laid down by the Sarfaesi Act and wilfully violated the RBI’s guidelines.

A cancellation of UVARCL’s registration at this stage would mean the resolution plans of bankrupt telcos RCom and Aircel could get scrapped and set back State Bank of India’s plans to recover Rs 12,000 crore loaned to the two telcos. In the case of RCom, lenders have approved UVARCL as a key bidder and the proposal is currently before the bankruptcy court.

The RBI’s rejection of the Aircel resolution plan brought into focus the conflict between the insolvency law and the Sarfaesi Act.

Source : PTI