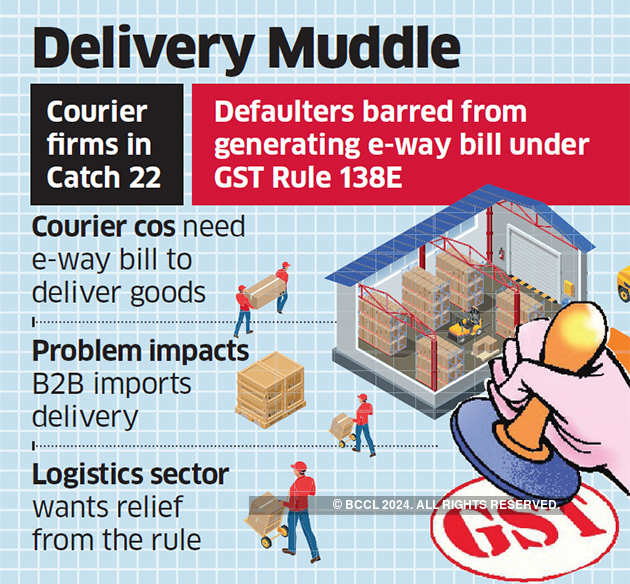

Courier companies such as FedEx, DHL and UPS are in a bind over delivering imported goods to customers because of a goods and services tax rule that bars defaulters from issuing e-waybills. The document is mandatory for transport of goods worth over Rs 50,000.

On the other hand, the customs department won’t hold such goods in its storage once they’re cleared. The companies, including local ones such as DTDC, Safe Express, Gati and Delhivery, have petitioned the government to seek a way out of the dilemma. The government said it’s examining the issue.

GST Rule 138E, which took effect in November, doesn’t allow an entity that hasn’t filed returns for two straight months to generate an e-waybill.

While the rule won’t impact direct deliveries to ecommerce customers, business-to-business (B2B) orders from overseas will likely get hit.

Import consignments of companies, which may have missed filing returns and are unable to generate an e-waybill, cannot be delivered. But the goods cannot be kept inside the customs premises once cleared.

“As per customs regulations, goods may not be retained in the customs premises post clearance,” Vijay Kumar, chief executive officer of the Express Industry Council of India lobby group. “But moving the goods outside the customs premises without e-waybill would result in noncompliance from a GST standpoint.”

Courier companies have no means of checking whether their customers are GST compliant. “The task itself would be monumental given the volume of transactions and number of clients,” Kumar said. “Tracking such compliances would lead to operational challenges… delay in delivery of goods and reduction in operational efficiency.”

Since courier companies get the goods cleared from customs on behalf of those that place the orders, under the end-to-end logistics model, they face the brunt of the rule, experts said.

“While GST was intended to simplify supply chains, logistics businesses have been facing a few challenges such as EWBs on import consignments, which need to be discussed, as this is a key ingredient in improving the ease of doing business,” said MS Mani, partner at Deloitte India.

The government is examining the matter to see how it can be resolved, said a senior government official, adding, “States have some reservations on the issue.”

The official said one option would be for courier companies to seek a written undertaking from customers to the effect that they’re GST compliant. The issue will be taken up again with states, he said.

Source : Economic Times