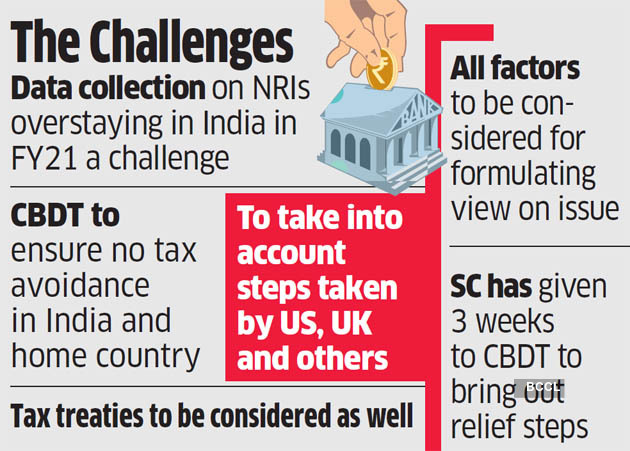

The Central Board of Direct Taxes (CBDT) is evaluating multiple aspects including double taxation avoidance, best practices by other countries and tax treaties, before arriving at a view on determining tax residency for non-resident Indians or NRIs having overstayed in India in FY 21, a senior official said.

“We will have to make sure that it should not be the case that NRIs income becomes tax free in India as well as their home country,” the official said, asking not to be named.

Measures or directions taken by countries such as the US, UK and others would also have to be considered such that the view India takes is in line with international peers. Several countries in Europe and the UK have initiated second or third waves of lockdowns due to resurgence in Covid 19 cases even as vaccination drives have begun.

“We will also have to look at tax treaties before formalising a view,” the official added.

However, the biggest challenge the Board is facing is collection of data of the number of people having got impacted by overstay and lack of clarity of rules.

The official added that while international travel for most part of FY 21 was barred and opened up later on in a restricted manner, the actual number of people who may have stayed more than 182 days would be tough to ascertain.

Data would be critical for determining the scale of relief that the Board needs to provide, and hence formulate its response to the Supreme Court.

The SC has given CBDT three weeks to decide on relief to be granted to NRIs on payment of income tax for the ongoing financial year. It is hearing a petition filed by an NRI who had stayed more than 182 days in India due to the lockdown and therefore may have to pay tax in India on his global income.

The Board had issued a clarification in May last year for FY20, on the aspect of residency under Section 6 of the I-T Act wherein various relaxations were provided to NRIs who could not travel back to their country of work or residence because of the lockdown.

CBDT has not issued any circular for payment of income tax by NRIs staying beyond 182 days in India due to the pandemic in FY 21.

Source : PTI