New Delhi: The upcoming budget could unveil a new and continuous framework for faster resolution of disputes over direct taxes.

The government is considering options such as mediation or a permanent dispute resolution system with pre-specified benchmarks on the lines of the ‘Vivad Se Vishwas’ scheme have been discussed, a person familiar to the pre-budget discussions said.

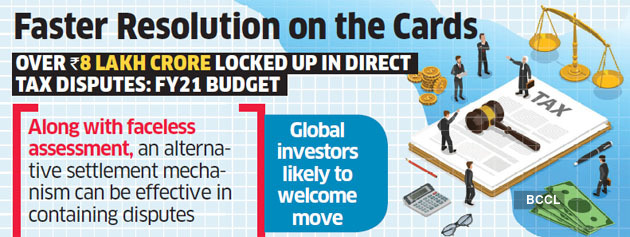

“Various options have been discussed… A final view should be taken shortly,” the person told ET. The idea is to prevent disputes and reduce litigation. According to the FY21 budget, more than Rs 8 lakh crore is locked up in direct tax disputes. It is being felt that along with the already introduced faceless assessment, an alternate settlement mechanism can be very effective at keeping disputes contained and would also be appreciated by the global investors.

Settlement mechanism is one option available at present, but it provides only a one-time opportunity to resolve disputes. There is also a limitation on the kind of cases that can be taken up for resolution under this mechanism. A taxpayer can file an application only if his case is pending before the assessing officer and the assessment has not become time-barred. Moreover, there is usually a considerable delay in disposal of settlement applications. Alternate dispute mechanism that is being considered seeks to resolve disputes at a very early stage.

“This is especially topical in today’s times when many potential international tax disputes are likely to revolve around facts and apportionment of global income in the light of legislative changes and principles inspired by OECD’s (Organisation for Economic Cooperation and Development) Base Erosion and Profit Shift (BEPS) project,” said Sudhir Kapadia, national tax leader at EY India.

Source : Economic Times