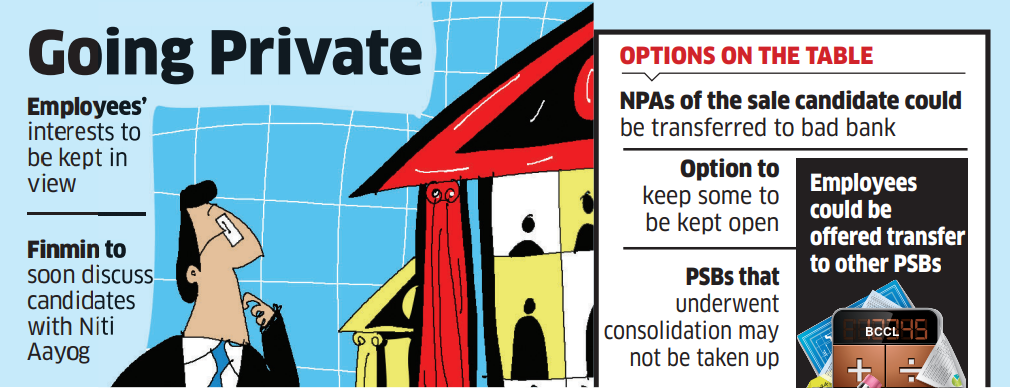

The government could hive off the non-performing loans of the two public sector banks that are to be selected for privatisation and transfer some of their employees to other state-run lenders in a bid to make them attractive for buyers.

The government is likely to consider only banks that were not part of the recent consolidation, which would exclude Punjab National Bank, Bank of Baroda, Canara Bank and State Bank of India from the privatisation process. “We could clean up the balance sheet and then offer the bank for sale, if it would get better valuations… All options are open,” a senior government official said.

Finance minister Nirmala Sitharaman said in the budget for FY22 that the government intends to privatise two public sector banks and one state-run general insurer in the next financial year.

The finance ministry is likely to hold discussions with Niti Aayog over the next 10 days to identify the candidates for privatisation.

The government will then begin the groundwork for the process, which will include legal changes and discussions with the Reserve Bank of India on the criteria for potential buyers.

An RBI working group had suggested in November that large corporate houses should be allowed to own banks by amending the Banking Regulation Act.

Workers’ Interest

The interests of employees will also be considered and they could be offered the option to shift to another PSB before privatisation.

Sitharaman told ET in an interview published on February 13 that the interests of all sections including workers would be safeguarded. “We obviously have to negotiate with those bidders to see that the workers’ interests are safeguarded, not just for today but also if the commitment is to ensure that their pensions will be paid, it will be definitely something which I will have to keep in mind… We will have to talk with everybody,” she had said.

Non-consolidation candidates preferred

Banks that were part of the consolidation exercise will be likely be excluded from the privatisation process as they are still managing integration issues and privatising them would add to complexity.

“Consolidation exercise is carried out at various levels including branches, ATMs, people, business, software,” the official said, adding that the process was not complete in some cases because of the disruption caused by Covid-19.

The government announced the merger of 10 public sector banks into four big ones in August 2019, bringing down the number of PSBs in the country to 12 from 27.

Oriental Bank of Commerce and United Bank of India were merged into Punjab National Bank; Syndicate Bank was merged with Canara Bank; Allahabad Bank with Indian Bank, and Union Bank of India with Andhra Bank and Corporation Bank.

Of the 12 PSBS, Indian Overseas Bank, Central Bank of India and UCO Bank are under the RBI’s Prompt Corrective Action framework, a set of guidelines for lenders that become undercapitalised due to poor asset quality or turned vulnerable due to loss of profitability.

Source : Times of India