New Delhi: The government imposed a tax collection at source (TCSNSE -0.42 %) — akin to TDS on remittances — after an internal survey by the income tax department showed that a large number of those sending out money had not filed income tax returns.

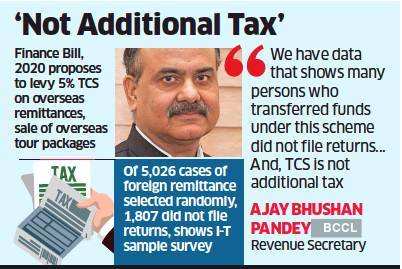

The finance bill 2020 has proposed an amendment to section 206C to levy 5% TCS on overseas remittance and for sale of overseas tour package. “We have data that shows many persons who transferred funds abroad under this scheme did not file income tax returns. Normally people remitting big amounts should be in income tax bracket and paying income taxes. Therefore, we have to have this move. And, contrary to misinterpretation in a certain section of media, 5 % TCS on foreign remittance is not an additional or new tax. It is like TDS which you can adjust against your total income tax liability,” said revenue secretary Ajay Bhushan Pandey

Of the 5,026 selected cases of foreign remittance, data showed that 1,807 did not file returns. Last year, $14 billion was sent out using the liberalised remittance scheme. This figure was less than $1 billion in 2009- 2010.

Under the liberalised remittance scheme, individuals are allowed to send out $250,000 in a year. Once the finance bill is passed, a 5% TCS will be levied on such foreign remittance, which is not a new tax but whose credit can be claimed while paying income tax or filing tax returns.

According to the budget provision, any authorised dealer receiving an amount or an aggregate of amounts of ?7 lakh or more in a financial year for remittance out of India under the scheme is required to deduct 5% TCS. In cases where such remittances not supported by PAN or Aadhaar the TCS rate would be 10%.

This TCS can be adjusted against the final tax liability of the person and is designed to get such persons to file tax returns.

You can get your monthly TDS reduced if it is a salaried individual or adjust against advance tax payment when the next instance falls due, Pandey said.

The Enforcement Directorate (ED) has come across a number of cases in which the liberalised remittance scheme was used by commodity traders to carry out a hawala operation in West Asia.

There have even been instances of misuse of this window to send money more than the permissible limit. TCS will allow for better tracking and allow the department to collect some tax on these transactions. If a person does not file return, the government would get to keep this 5% amount.

Source : Times of India