Budget 2020 introduced a new income tax regime for individual taxpayers. However, the option for such concessional tax regime requires the taxpayer to forego certain specified deductions. These include standard deduction of Rs 50,000, deduction under section 80C of Rs 1.5 lakh and interest on self-occupied property of Rs 2 lakh, deductions which are availed by most taxpayers. As a result, the concessional tax regime may not always be beneficial.

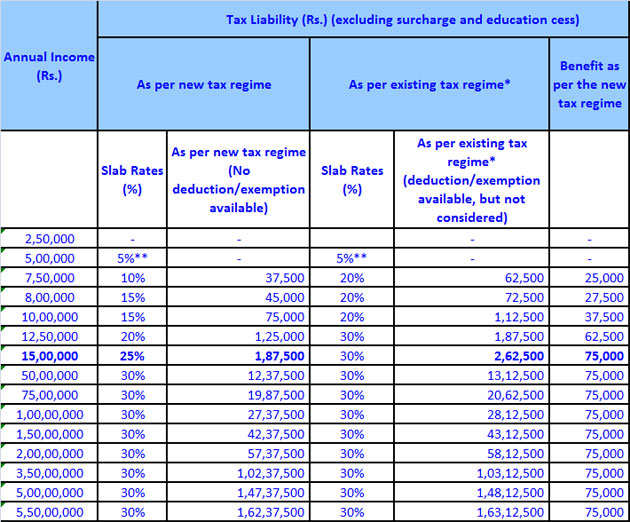

Based on the illustrative table below, it is evident that the maximum benefit that can be availed under the new tax regime (in case no investments are made) is Rs 75,000 in terms of tax savings. As a result, unlike the corporate tax concessional tax rate regime which reduces tax rates across income levels, the concessional tax rate has limited application and will benefit persons in the lower income brackets. The highest personal tax rate, which is 42.7 per cent, will continue to be a major challenge for high net worth individuals (HNIs). A comparative table reflecting the existing and personal tax regime rates is provided below:

*No tax up to Rs. 500,000 taxable income, as Rebate under section 87A is available

*Basic exemption income slab in case of a resident individual of the age of 60 years or more (senior citizen) and resident individual of the age of 80 years or more (very senior citizens) at any time during the previous year, continues to remain the same at Rs 3 lakh and Rs 5 lakh, respectively, in the existing tax regime.

A. The pros of the new regime are as follows:

- Reduced tax rates and reduced compliances: The new regime provides for concessional tax rates vis-à-vis tax rates in the existing or old regime. Further, as most of the exemptions and deductions are not available, the documentation required is lesser and the tax filing is easier.

- Investor may not prefer to lock-in funds in the prescribed instruments for the specified period: Under the new regime, all taxpayers would be treated at par and benefit of deduction/allowances would not be a criteria for availing the tax exemption. This may be helpful for those categories of taxpayers who may not subscribe to the specified modes of investments, as most of the investments have a lock-in period, before which it cannot be withdrawn. They can invest in open-ended mutual funds/instruments/deposits, which provides them good returns as well as flexibility of withdrawal as well. For instance, certain eligible instruments have a longer lock-in period such as fixed deposits with banks and post offices have a lock-in period of five years, equity-linked savings schemes (ELSS) is for a period of three years, National Savings Certificates (NSC) for five years, etc.

- Increased liquidity in the hands of the taxpayer: The reduced tax rate would provide more disposable income to the taxpayer, who could not invest in specified instruments due to certain financial or other personal reasons.

- Flexibility of customising the investment choice: The existing tax regime provides for deductions to the taxpayer, provided he makes investments in certain instruments and manner as prescribed in the Act. This restricts the investment choices for the taxpayer as he has to make the investments only in the instruments specified. However, the new regime provides taxpayer with a flexibility of customising their investment choices.

The cons of the new regime are as follows:

- Non-availability of certain specified deductions: The new tax regime does not allow the taxpayer to avail certain specified deductions. Illustrative list as under:

(a) Clauses referred in section 10 as follows:

(i) Clause (5) – Leave travel concession;

(ii) Clause (13A) – House rent allowance;

(iii) Clause (14) – Special allowance detailed in Rule 2BB (such as children education allowance, hostel allowance, transport allowance, per diem allowance, uniform allowance, etc.);

(iv) Clause (17) – Allowances to MPs/MLAs;

(v) Clause (32) – Allowance for clubbing of income of minor;

(b) Exemption for SEZ unit under section 10AA;

(c) Standard deduction, deduction for entertainment allowance and employment / professional tax as contained in Section 16;

(d) Interest under section 24 in respect of self-occupied or vacant property (loss under the head IFHP for rented house shall not be allowed to be set off under any other head and would be allowed to be c/f as per extant law);

(e) Additional depreciation under section 32(1)(iia);

(f) Deductions under sections 32AD, 33AB and 33ABA;

(g) Various deductions for donation or expenditure on scientific research contained in sub-clause (ii) or sub-clause (iia) or sub-clause (iii), of sub-section (1) or sub-section (2AA) of section 35;

(h) Deduction under section 35AD or section 35CCC;

(i) Deduction from family pension under clause (iia) of section 57;

(j) Any deduction under chapter VI-A (like section 80C, 80CCC, 80CCD, 80D, 80DD, 80DDB, 80E, 80EE, 80EEA, 80EEB, 80G, 80GG, 80GGA, 80GGC, 80IA, 80-IAB, 80-IAC, 80-IB, 80-IBA, etc.). However, deduction under sub-section (2) of section 80CCD (employer contribution on account of employee in notified pension scheme) and section 80JJAA (for new employment) can be claimed.

Making your choice

In light of the above and considering the new personal tax regime wherein certain deductions and exemptions would not be applicable if taxpayers opt for the concessional new tax regime, they may evaluate both the regimes. Any taxpayer who is looking for flexibility in investment choices and does not want to invest in the specified eligible instruments, may consider opting for the new tax regime. However, it is advisable to do a comparative evaluation under both regimes, before opting to continue with the old one or opting for the new one.

It is notable that the choice can be exercised every year and any regime which is beneficial can be adopted by the individual (except for those who have income from business or profession). Individuals who have income from business or profession cannot switch between the new and old tax regimes every year. If they opt for the new taxation regime, such individuals get only one chance in their lifetime to go back to the old regime. Further, once switched back to existing tax regime, they will not be able opt for new tax regime unless their business income ceases to exist.

It is important to note that the income tax department has brought out a tax comparison utility, which is available on their web portal and in which, an individual taxpayer can evaluate which option is better for him/her. The link to the same is as under: https://www.incometaxindiaefiling.gov.in/Tax_Calculator/

The pros and cons of the old tax regime

A. The pros of the old regime are as follows:

- The older regime by enforcing investments in specified tax-saving instruments, over the period inculcated the savings culture in individual and led to savings for any future eventuality like marriage, education, purchase of house property, medical, etc.

- India’s gross savings rate was approximately 30 per cent in March 2019 and the domestic savings by individuals is a significant contributor to the overall savings rate. If more individuals will opt for the new regime, the savings rate would decrease, nevertheless the consumption cycle and demand would be revived.

B. The cons of the old regime are as follows:

- The tax benefits under the old regime is available on investments in specified instruments and also there is a specific lock-in prescribed for most of the instruments from three-five years. This may not be not a suitable tax-saving option for millennials, who prefer to spend than save, and senior citizens, as they would prefer having liquidity in their hands and investing in instruments which have a flexible and open-ended tenure.

- The investor cannot opt for any other star-rated funds, which may be performing better than the specified instruments, which are mostly risk-averse in nature and may not provide significant returns over the period of investments.

- In case of assessment proceedings before the tax authorities, documentation and proof of investments is required to be retained in the old regime, which may not be required in the new regime

Source : Financial Express